Card query Service (pre-authorization)

This section explains in pre-authorization context. Look for Flow for further details

From a pre-authorization NIT with status NOV (new), you can perform a card BIN query (first six digits) in SiTef to obtain data on your capacities (possibility of payment in installments, maximum installments, security code requirement, etc.), or knowing which store authorizer is best suited for that payment.

In case of Visa Checkout transactions, this service will also return card and user data returned by VISA.

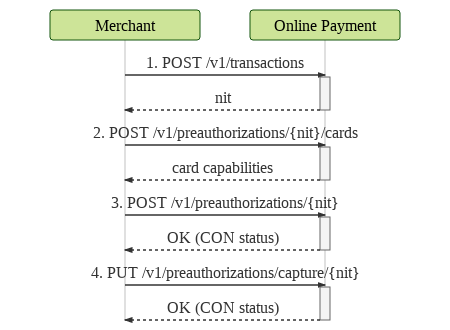

Flow#

Flow description:

- Merchant creates a transaction on Carat Portal passing some information, as merchant ID, installments quantity and order code e gets as response a

nit(Transaction Identifier Number). - Merchant sends the

nitobtained previously and card data to be queried. Thus, Carat Portal returns data related to the card sent. - Virtual Store then proceeds consuming the payment effectuation service, passing

nitand the buyers card data. On success, the payment transaction will change its status toCON(confirmed).

Call details#

- Resources:

/v1/preauthorizations/{nit}/cards - HTTP Method:

POST

Obs.: despite being a query, the POST method was chosen due to security matters.

- Request format:

JSON - Response format:

JSON - Header parameters:

| Parameter | Description | Format | Mandatory |

|---|---|---|---|

Content-Type | Fixed value "application/json" | = 15 A | Yes |

merchant_id | Carat Portal store's ID. Production and certification IDs are different. | ||

merchant_key | Store authentication key in Carat Portal. Production and certification keys are different. | ≤ 80 A | Yes |

nit | Pre-authorization transaction ID in Carat Portal. Obtained at beginTransaction response. | = 64 A | Yes |

Card query example with authorizer's parameter#

Request:

To use this example, don't forget to define the variable {{url}} to the value

sandbox.ecomm-bin.fiserv.com.br

Response:

Card query example without authorizer's parameter#

Request:

To use this example, don't forget to define the variable {{url}} to the value

sandbox.ecomm-bin.fiserv.com.br

Response:

Visa Checkout card query example#

Request:

To use this example, don't forget to define the variable {{url}} to the value

sandbox.ecomm-bin.fiserv.com.br

Response:

Card query example with additional data for iCards routing via SiTef#

Request:

To use this example, don't forget to define the variable {{url}} to the value

sandbox.ecomm-bin.fiserv.com.br

Response:

Response codes

See reference on API codes - response codes

Request parameters#

In the table below there is a description of the card query service request parameters:

| Parameter | Description | Format | Size | Mandatory |

|---|---|---|---|---|

authorizer_id | Authorizer ID used in transaction, as listed in the Authorizer's list. Mandatory only when "wallet_transaction_id" is sent. | N | ≤ 3 | NO |

number | Buyer's card number PAN). | N | ≤ 19 | NO |

token | Hash of stored card at Carat Portal. It's not allowed to send the fields number and tokenon the same request. | AN | = 88 | NO |

wallet_transaction_id | Digital wallet transaction ID. For now, this feature is only available for Visa Checkout (authorizer_id:406). It's not allowed to send the fields number, tokenor wallet_transaction_id on the same request. | AN | ≤ 25 | NO |

Note: Although not mandatory, it is recommended to send authorizer_id for card consultation, especially for routing by SiTef, in order to more effective behaviors in relation to the routing registered to the authorizer.

Response parameters#

If successful, the HTTP response code will be 200. Any other code should be interpreted as an error. In the table below there is the description of the card query service response parameters:

| Parameter | Description | Format | Size |

|---|---|---|---|

code | Carat Portal response code. Anything besides "0" means failure. See more information at the Response Code document | N | ≤ 4 |

message | Carat Portal response message. | AN | ≤ 500 |

status | Carat Portal pre-authorization transaction status. | AN | = 3 |

authorizer_code | Authorizer responde code. | AN | ≤ 10 |

authorizer_message | Authorizer's response message | AN | ≤ 500 |

acquirer_name | Acquirer's name. Ex.: Cielo | AN | ≤ 256 |

authorizer_id | Authorizer ID use in transaction. | N | ≤ 3 |

is_customer_id_required | Indicates wether the gathering of customer's ID is mandatory. | T/F | ≤ 5 |

is_expiry_date_required | Indicates wether the gathering of the buyer's card expiration date is mandatory. | T/F | ≤ 5 |

is_installment_funding_enabled | Indicates wether the installment is enabled. | T/F | ≤ 5 |

is_security_code_required | Indicates wether the gathering of card's security code is mandatory. | T/F | ≤ 5 |

is_spot_sale_enabled | Indicates if spot sale is enabled. | T/F | ≤ 5 |

is_with_interest_sale_enabled | Indicates if payment with interest is enabled. | T/F | ≤ 5 |

is_without_interest_sale_enabled | Indicates if payment without interest is enabled. | T/F | ≤ 5 |

max_installments_with_interest | Max installments with interest. | N | ≤ 2 |

min_installments_with_interest | Min installments with interest. | N | ≤ 2 |

visa_checkout_data | Returned data from Visa Checkout. | ||

financing_plan_list | Object consisting of an array of financing plans presented in Via Certa Financing routing. A financing plan consists of the following fields: - cod_plano: financing plan identification code, which must be sent at the time of payment; - tipo_plano: financing plan type code;- desc_plano: plan's description which can be presented to the buyer; - parc_plano: maximum number of possible installments for the plan. | ||

is_customer_postal_code_required | Indicates the obligation to collect the user's zip code (CEP in Brazil). | T/F | < 5 |

key | Prefix name. | AN | ≤ 1024 |

value | Prefix value | AN | ≤ 1024 |